by Chay Godfrey

Electric and Hybrid vehicles are a rapidly expanding trend in the UK considering they have the potential to revolutionise how energy is used, created and redirected. These vehicles are solutions to the negative environmental impacts which we are currently facing in today’s world. A continuous list of benefits the vehicles offer; reduced running costs, higher resale values (compared to fuel-based vehicles), instant torque and fewer emissions which is a great selling point for company car drivers based on the decreased BIK charges we will start seeing from April 2020. Today, it is estimated that 1 in 10 new car registrations are now either electric or hybrid vehicles.

Electric and Hybrid vehicles are a rapidly expanding trend in the UK considering they have the potential to revolutionise how energy is used, created and redirected. These vehicles are solutions to the negative environmental impacts which we are currently facing in today’s world. A continuous list of benefits the vehicles offer; reduced running costs, higher resale values (compared to fuel-based vehicles), instant torque and fewer emissions which is a great selling point for company car drivers based on the decreased BIK charges we will start seeing from April 2020. Today, it is estimated that 1 in 10 new car registrations are now either electric or hybrid vehicles.

Electric vehicles need to be charged before commuting. The period of charging time varies depending on the vehicle, it could be as little as 30 minutes or up to 12 hours. Various factors such as the size of the battery and the power of the charging station all contribute to the overall charging period. The average electric car with a 60kWh battery will take under 8 hours to charge from empty to full. Besides, with a rapid charger which can be purchased as an extra, you can reduce these periods significantly. The range is a popular topic which is discussed when electric vehicles arise in conversation with many individuals having “range anxiety”. Pure electric vehicles can have ranges up to 375 miles, therefore it is personal preference regarding the electric vehicle which suits you best. Considering the speed of rapid chargers, charging your car on a long journey only consists of taking a pit stop at the next service station for a coffee whilst your vehicle charges. Whilst hybrids are very similar to electric vehicles, they will depend on the use of fuel. A hybrid would be more suitable if the infrastructure for charging your vehicle wasn’t on the route. With the demand for electric vehicles rapidly expanding we are most definitely likely to see an increased quantity of charging stations placed across the country.

View charging points near you visit ZapMap

You can’t emit any lower emissions than something which has no tailpipe, which is exactly what a pure eclectic vehicle contains. This isn’t considering the carbon intensity which is drawn from their grid influences, but our power must come from somewhere. Approximately 60% of greenhouse gas emissions materials from energy-related sectors such as transport, proving why we must make this change to economically sustainable vehicles. Plug-in hybrid vehicle emissions are also considerably low; however, they tend to be slightly heavier than your normal model due to their heavier battery. It is extremely beneficial to the Hybrid if charged often to make sure it doesn’t have to rely on the use of fuel. However, if the hybrid is constantly used by running on the use of fuel and not electricity you lose the cost benefits of buying a hybrid. Although with Hybrid vehicles you have the flexibility of travelling where you want and when you want, not having to make that pit stop to recharge.

You can’t emit any lower emissions than something which has no tailpipe, which is exactly what a pure eclectic vehicle contains. This isn’t considering the carbon intensity which is drawn from their grid influences, but our power must come from somewhere. Approximately 60% of greenhouse gas emissions materials from energy-related sectors such as transport, proving why we must make this change to economically sustainable vehicles. Plug-in hybrid vehicle emissions are also considerably low; however, they tend to be slightly heavier than your normal model due to their heavier battery. It is extremely beneficial to the Hybrid if charged often to make sure it doesn’t have to rely on the use of fuel. However, if the hybrid is constantly used by running on the use of fuel and not electricity you lose the cost benefits of buying a hybrid. Although with Hybrid vehicles you have the flexibility of travelling where you want and when you want, not having to make that pit stop to recharge.

Although electric cars are more expensive to buy compared to a fossil fuel dependent and hybrid vehicle the overall running costs are considerably lower depending on your household electricity tariff. Under the curr

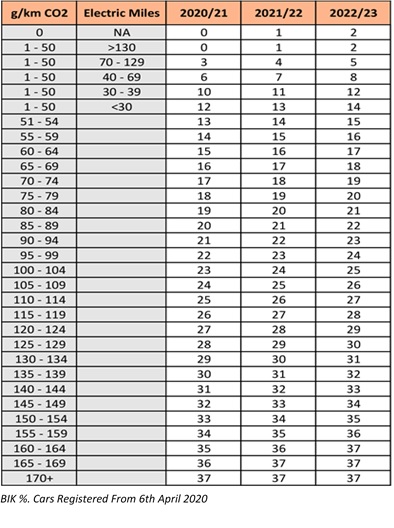

ent government system, employees who have company vehicles pay a tax; benefit in kind (BIK). The BIK charge is in relation to the P11D value of the car, which has previously been determined by the manufacturer when the car was brand new. Other factors including the CO2 emissions a vehicle emits as well as the individual’s tax rate that is collected through the PAYE system. This system is receiving a prospective change as of April 2020.

The government wants to create an incentive for UK motorists to make a switch from fuel-based vehicles to electric or hybrid. Currently, electric vehicle drivers pay 16% to drive their electric vehicle, but this is all changing. Electric vehicle owners will pay 0% BIK as of April 2020 and 1% BIK in 2021, whilst hybrid vehicles must emit less than 50 grams per kilometre of CO2 and can travel at least 130 miles solely as an electric vehicle. This may come as great news for hybrid drivers, unfortunately, there are no current hybrid vehicles which meet these requirements. There have been tax breaks allocated for drivers, however, these aren’t anywhere near comparable as newly introduced measures. Hybrids with an electric range of fewer than 30 miles will have a 13% BIK charge from April 2020.

The government wants to create an incentive for UK motorists to make a switch from fuel-based vehicles to electric or hybrid. Currently, electric vehicle drivers pay 16% to drive their electric vehicle, but this is all changing. Electric vehicle owners will pay 0% BIK as of April 2020 and 1% BIK in 2021, whilst hybrid vehicles must emit less than 50 grams per kilometre of CO2 and can travel at least 130 miles solely as an electric vehicle. This may come as great news for hybrid drivers, unfortunately, there are no current hybrid vehicles which meet these requirements. There have been tax breaks allocated for drivers, however, these aren’t anywhere near comparable as newly introduced measures. Hybrids with an electric range of fewer than 30 miles will have a 13% BIK charge from April 2020.